Sean Doyle

Sean is a principal at FitzMartin, and our leading mind and voice on sales and marketing strategy. Sean is particularly adept at applying the science of behavior change to the art of sales and marketing. It’s an approach that he and FitzMartin have developed over thousands of client engagements since 1992.

Never miss a post

Subscribe below to receive blog updates.

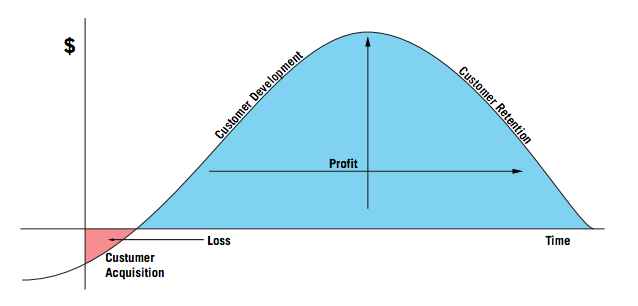

Have you ever met a business owner that likes to see "red"? Not me. But we must understand that ALL customers start in the red. Agree?

Have you ever met a business owner that likes to see "red"? Not me. But we must understand that ALL customers start in the red. Agree?

Over the years I have come to believe that two metrics are more important than any other. The first, to understand "the red." The second...you have to understand the ROI.

Minimum, these two offer a starting point. Once these two are in hand, then the nuanced and specific metrics for your specific business application can be built into your dashboard. For now, if you do not have these two in hand, start here.

1) Customer Acquisition Cost (CAC)

This is your total Sales and Marketing cost -- add up all the program or advertising spend, plus salaries, plus commissions and bonuses, plus overhead -- in a time period, divided by the number of new customers in that time period. That time period, by the way, could be a month, a quarter, or a year. For instance, if you spent $300,000 on Sales and Marketing in a month and added 30 customers that month, then your CAC is $10,000.

Easy right?

2) Ratio of Customer Lifetime Value to CAC (LTV:CAC)

For companies that have a recurring revenue stream from their customers -- or even any way for customers to make a repeat purchase -- you need to estimate the current value of a customer and compare that to what you spent to acquire that new customer.

To compute the LTV, you need to take the revenue the customer pays you in a period, subtract out the gross margin, and then divide by the estimated churn % (cancellation rate) for that customer. So, for a type of customer who pays you $100,000 per year where your gross margin on the revenue is 70%, and that customer type is predicted to cancel at 16% per year, then the LTV is $437,500.

However, this view of LTV is missing something that's pretty important. The trick with LTV is that it's based on the present value of your future cash flows. Interest rates (i.e. the time value of money) complicate this measurement. It forces you to overestimate LTV. To have a true present value (in today's dollars) of a customer's LTV, you have to apply a discount rate to get the net present value of the customer's cash flows (the finance way of saying "lifetime value"). The =NPV function in Excel is extremely easy/helpful for this (but with that approach, you have to map out each year's cash flows for the particular customer). This is a simplified LTV formula to consider. Working with the internal finance folks will be critical to this and other rations and metrics!

$M = net dollar margin (revenue - costs)

AC = acquisition cost

d = discount rate (collaboration within the finance guy will generate a useful discount rate)

r = retention rate; therefore...

LTV = [($M)*(1+d)/(1+d-r)] - AC

Now, once you have the LTV and the CAC, you compute the ratio of the two. If it cost you $100,000 to acquire this customer with an LTV of $437,500, then your LTV:CAC is 4.4 to 1.

For growing SaaS companies, most investors and board members want this ratio to be greater than 3X; a higher ratio means your Sales and Marketing have a higher ROI. Higher is not always better though; when the ratio is too high, you might want to spend more on Sales and Marketing to grow faster, because you are restraining your growth by under-spending, and making life easy for your competition.

What metrics do you use? Any more important than these?

Want to learn more? Click below...